The world of finance can be a confusing labyrinth, filled with terminology and ideas that make people scratch their heads. Two of the most important components are the primary and secondary markets, which play distinct yet interdependent roles in the journey of a security (stock, bond, etc.). This article aims to demystify these two phases, and shed light on how companies raise capital and what investors can expect from the trading landscape.

The world of finance can be a confusing labyrinth, filled with terminology and ideas that make people scratch their heads. Two of the most important components are the primary and secondary markets, which play distinct yet interdependent roles in the journey of a security (stock, bond, etc.). This article aims to demystify these two phases, and shed light on how companies raise capital and what investors can expect from the trading landscape.

The Birthplace: The Primary Market

Imagine a company with dreams of growth, but is restricted by its cash flow. Markets are that companies can raise capital through the issue of new securities. This process is associated with the Initial Public Offering, where a new company goes public. Investors get the chance to own the company’s future during an IPO. For more information, click primary market and secondary market

However, the primary market does not only apply to IPOs. Companies can raise money by other means for example, like by distributing shares or bonds to investors from institutions. The primary market has a major impact on companies’ growth plans, regardless the offering.

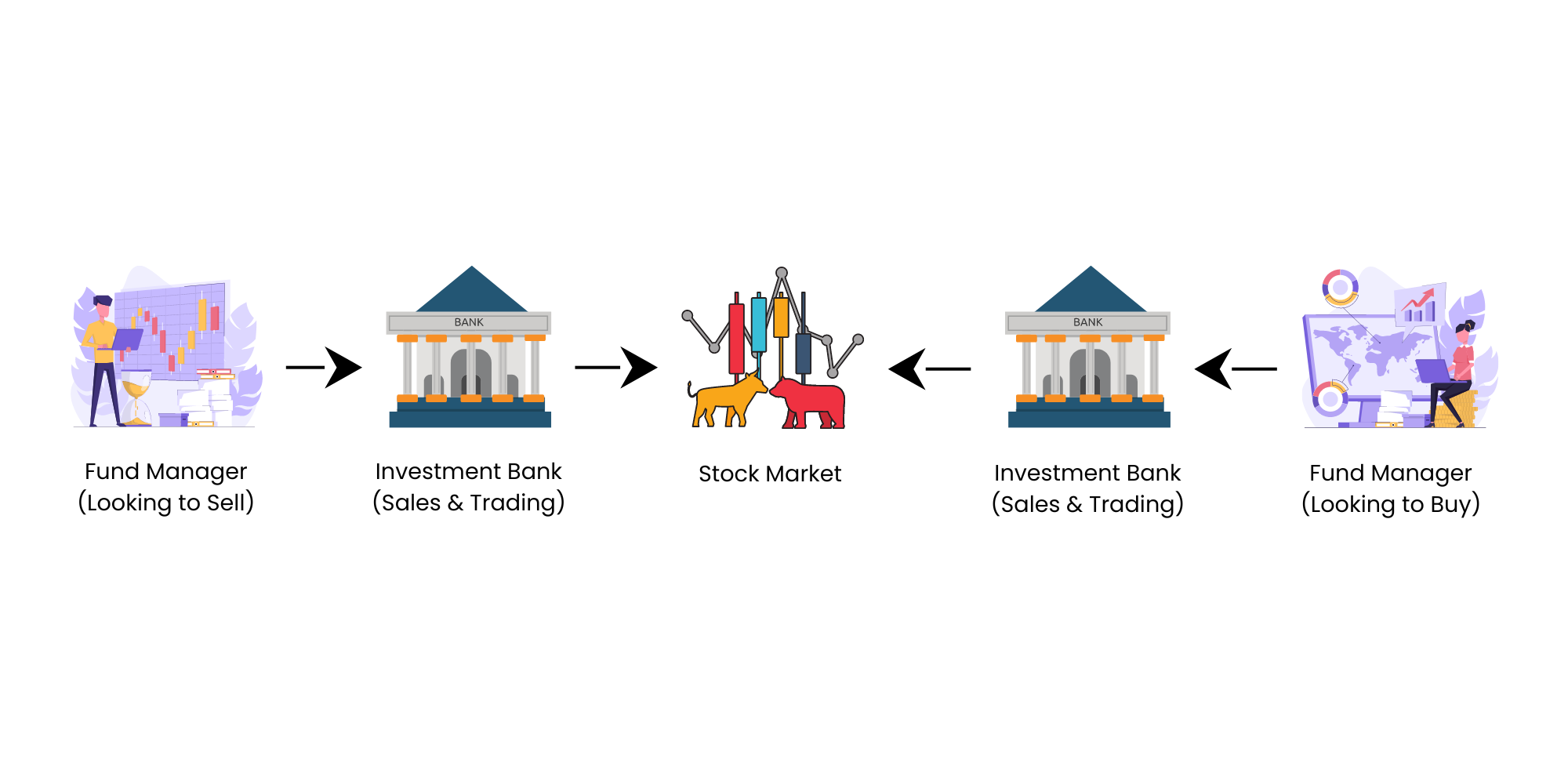

The secondary market: the trading floor

What happens next? This is where the bustling secondary market takes over. Think of the secondary market as a continuous marketplace where investors exchange securities they’ve already issued. Unlike the primary market, where firms issue new securities and the secondary market allows the selling and buying of existing ones.

The secondary markets provide investors with the benefit of liquidity. The ease with which an investment may be bought or sold is known as liquidity. When a company’s securities are listed on the secondary markets (like NYSE or NASDAQ), this allows investors to enter their positions and leave them quickly, allowing flexibility as well as potential greater yields.

The Circle of Securities : From IPOs and Everyday Trade

If we look at the whole lifecycle of a stock, it becomes clearer to identify the connection between the markets. When a company puts its shares on the primary market (IPO), the market is prepared to allow them to trade. After being listed, the shares can be bought and sold by investors, creating price swings based on supply and demand. This constant dance of buying-and-selling on secondary markets plays an important part in the process of determining prices.

Why should investors be concerned about this? Understanding Both Markets

For investors, understanding both primary and secondary markets is essential. The primary market provides opportunities to invest in promising businesses at the start of their journey, potentially reaping huge returns if the business succeeds. IPOs may be volatile and, consequently, have a greater risk for investors.

Secondary markets however, offer a greater variety of investment choices. Investors can purchase and sell existing securities based on their market research and analysis. While the secondary markets may have greater liquidity, they do not necessarily offer the same opportunities for explosive market growth as primary markets.

Investment: Choosing your market entry point

It all boils down to your individual investment objectives, as well as how much risk you are willing to accept. Investors looking for growth-oriented opportunities should look into carefully vetted IPOs. Investors who value stability and liquidity may consider companies listed in the secondary market to be more appealing.

The cycle continues: financing growth and market dynamics

The primary market as well as the secondary market work together to power stock markets. Businesses raise capital to expand through the primary market, and investors purchase existing securities on secondary markets. This creates a dynamic market that affects not only the health and fortunes of individual businesses, but the overall economy.

In Conclusion, Demystifying The Two Stages

By understanding the distinct roles of the primary and secondary markets, investors will be better equipped to navigate the complex world of finance. Whether you’re drawn to the thrill of IPOs or the established environment of the secondary market this knowledge empowers you to make educated investment decisions and potentially achieve your financial objectives.